vermont department of taxes myvtax

Electronic Transfer of W-2 1099 and WH-434 Filings. 6 sales tax 1 7 total tax.

Department of Taxes Payroll companies and employers should Use myVTax.

. DEPARTMENT OF TAXES Filing a Landlord Certificate online can save labor and time. GB-1229 - Vermont Department of Taxes ACH Credit Processing. The 3528 is business use 6351800 is rounded to 3500.

Local Option Meals Tax. Wind-Powered Electric Generating Facility Tax. Get Access to the Largest Online Library of Legal Forms for Any State.

Vermont Insurance Premium Tax Return. The 2083 business use 2501200 is rounded to 21. Tax examiners in this division can answer questions about Vermont personal income tax Homestead.

B 1200 square foot home with 250 square feet used as a home office. Insurance Premium Tax Form IPT-633. You have been successfully logged out.

Department of Taxes The eCuse system allows property owners to submit online applications to the Current Use Program and allows town clerks assistant town clerks and listers to view Current Use applications. Because this is less than 25 enter 0000. FY2023 Property Tax Rates.

Tax Credits Earned Applied Expired and Carried Forward if applicable Please Note. How to File the Land Gains Tax Return. Vermont School District Codes.

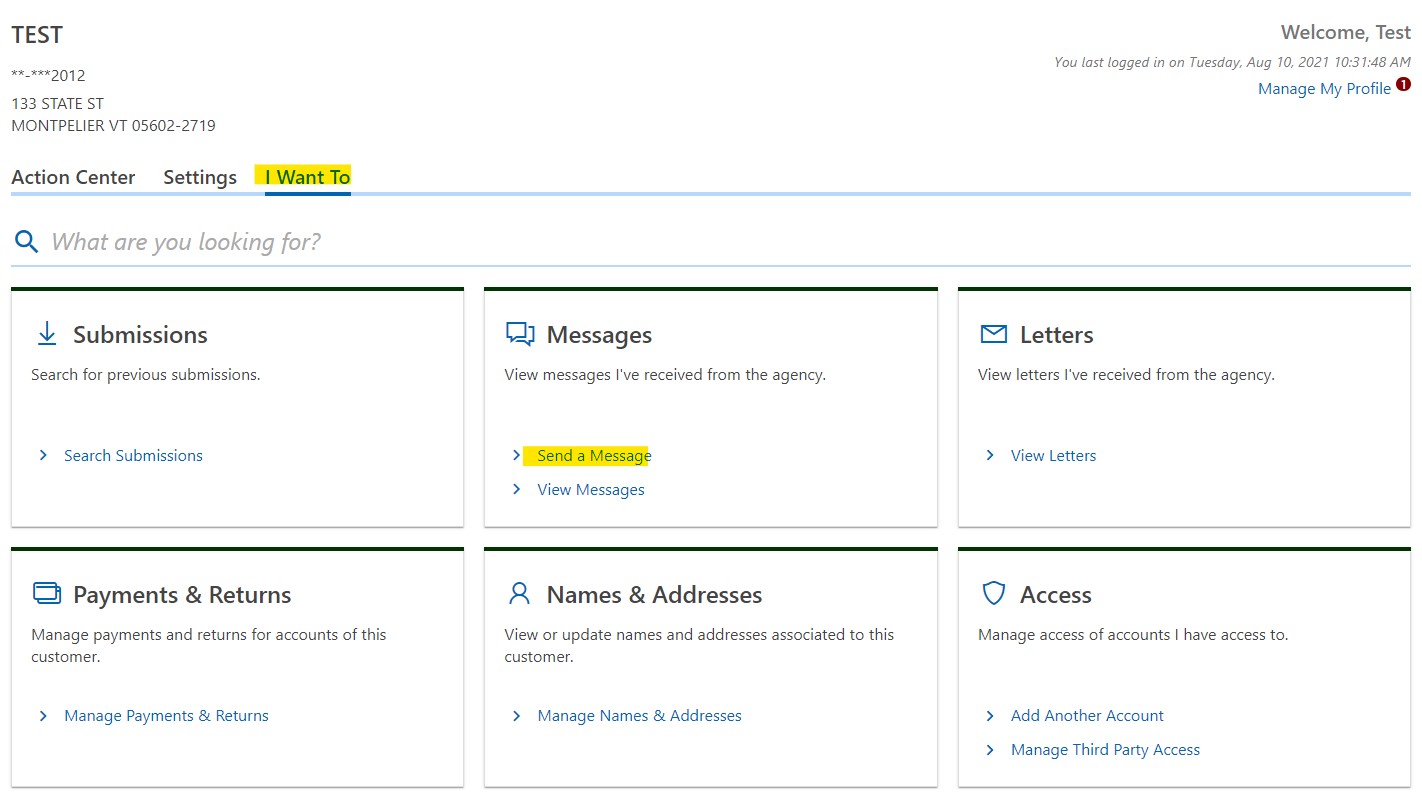

Free e-filing is available through myVTax for your Homestead Declaration Property Tax Credit Claim Renter Rebate Claim and Landlord Certificate. You can also email myVTax support or call us at 802-828-6802 or 802-828-2551. How Can We Contact the Vermont Department of Taxes for questions about Vermont personal income taxes.

Governor Phil Scott released a reopening guide to help Vermonters and local businesses see the path for a phased return to unrestricted travel business operations and event gatherings. Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am. Sign Up for myVTax.

Activate an account using a myVTax Access Code. A unique seven-digit number issued by the state to identify your business for the purpose of Unemployment Insurance Wage and Tax reporting. The Commissioner of Taxes has mandated the electronic filing of all Insurance Premium Tax returns through myVTax.

Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. Vermont State Tax information registration support. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Answer Simple Questions About Your Life And We Do The Rest. The Vermont Department of Taxes website is the best resource for Vermont taxes. 802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm.

We also have an instructional video available on our website. Register as an accountant attorney or third party tax professional to access client accounts. Add myVTax access for an existing Vermont Tax account.

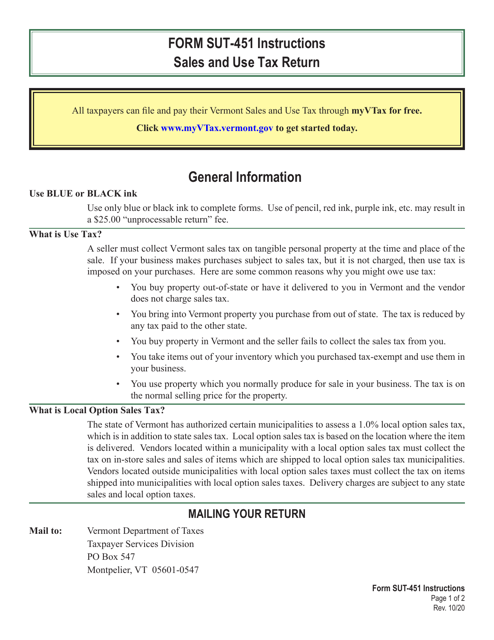

Local Option Sales Tax. A municipality may vote to levy the following 1 local option taxes in addition to state business taxes. Guide Tue 01112022 - 1200.

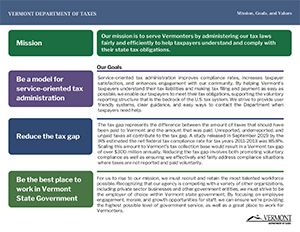

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. Vermont Department of Taxes Issues. Bulk upload or data enter W-2s1099WHT- 434 for electronic submission 1099 upload only Bulk upload quarterly withholding reconciliations for payroll services.

Stay informed on public health guidelines status updates FAQs and other resources from the Vermont Department of Health. Listers should contact the. MyVTax Payment Portal Vermontgov Freedom and Unity.

The mandate is effective for estimates for the quarter. Understand and comply with their state tax obligations. This guide provides step-by-step instructions on how to complete the online version of Form LC 142 Landlord Certificate at wwwmyVTaxvermontgov.

Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am. If you have questions or are in need of assistance please contact the Employer Services Unit at 802-828-4344. 9 meals tax.

File or Pay Online. For Listers and Assessors How to Search for Property Transfer Tax Returns. GB-1119 - WHT-434 Specifications for Electronic Filing copy.

We would like to show you a description here but the site wont allow us. Ad New State Sales Tax Registration. Ad The Leading Online Publisher of Vermont-specific Legal Documents.

Instructions for State of Vermont Departments How to Remit Tax Collections through ACH Credit Processing to the Vermont Department of Taxes Via the Vision Accounts Payable Module COPY. GB-1150 - myVTax Guide. The IRS provides a comprehensive website with federal forms instructions and more.

Local option tax is a way for municipalities in Vermont to raise additional revenue. You may now close this window. Please note that when you complete and submit your.

The portion used for business is taxed at the nonhomestead rate.

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes Youtube

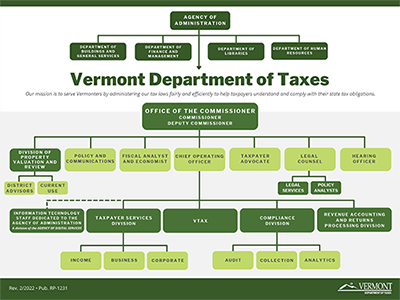

About The Department Department Of Taxes

Organization Department Of Taxes

Individuals Department Of Taxes

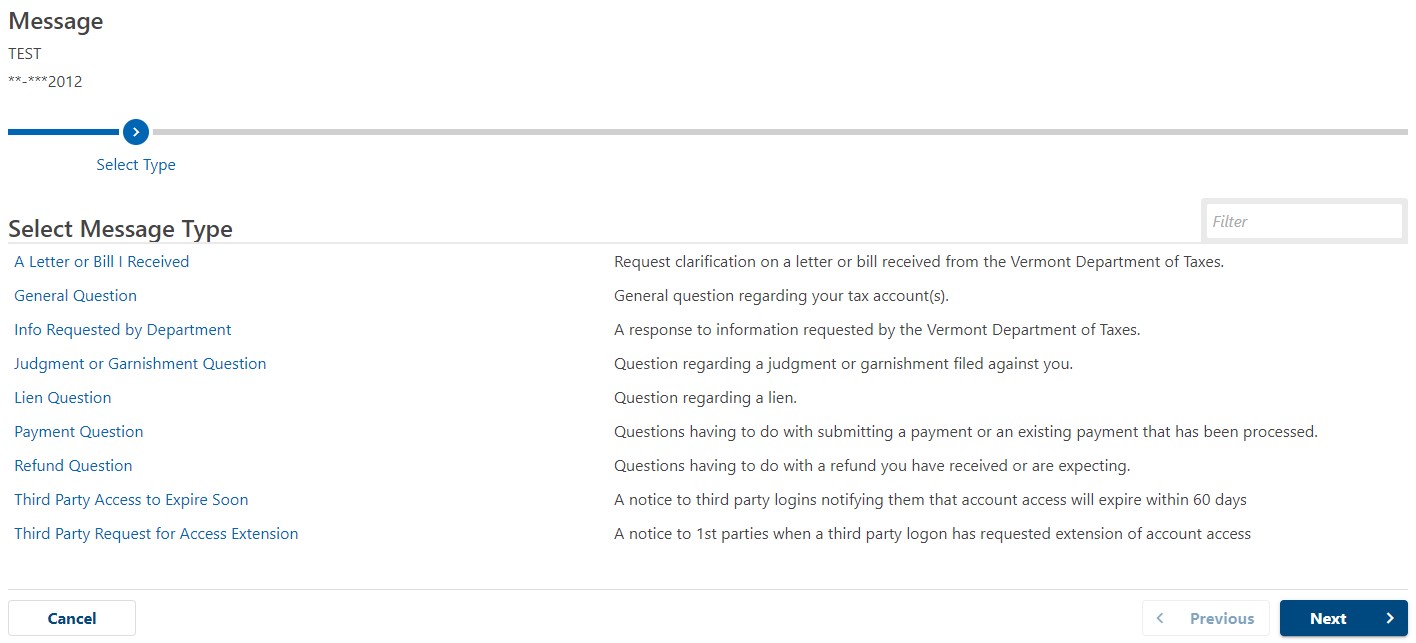

How To Send A Secure Message Department Of Taxes

Personal Income Tax Department Of Taxes

How To Send A Secure Message Department Of Taxes

Personal Income Tax Department Of Taxes

Download Instructions For Vt Form Sut 451 Sales And Use Tax Return Pdf Templateroller

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube